However, the management’s decision about the share buyback can also tell a lot about its expectations about future performance. If a company is buying back its shares, it could mean that it believes the shares are currently undervalued; if it’s selling, it might anticipate the shares becoming overvalued. Common stock can be defined as the amount that has been invested by the shareholders in exchange for shares of the company. It represents the initial capital that a company uses to start or expand its operations. The quantity of common stock is significant as it shows the level of faith that the investors have in the company’s future prospects.

- The reinvestment from the shareholders indicates their attitude towards the company, which is positive if the performance is good and as expected.

- An increasing trend in equity often signals a positive financial health of a company.

- However, it is also necessary to present additional information about changes in other equity accounts.

- But shareholder equity alone is not a definitive indicator of a company’s financial health.

- Common stockholders have more rights in the corporation in terms of voting on company decisions, but they are last on the priority list when it comes to paying.

- Cash takes up a large portion of the balance sheet, but cash is actually not considered an asset because it is expected that cash will be spent soon after it comes into the business.

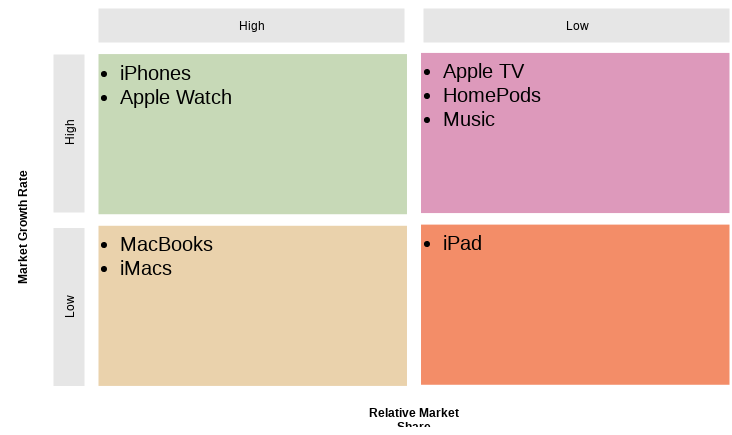

- In recent years, more companies have been increasingly inclined to participate in share buyback programs, rather than issuing dividends.

Components of shareholders’ equity

Aside from stock (common, preferred, and treasury) components, the SE statement includes https://www.bookstime.com/ retained earnings, unrealized gains and losses, and contributed (additional paid-up) capital. Shareholder equity (SE) is a company’s net worth and it is equal to the total dollar amount that would be returned to the shareholders if the company must be liquidated and all its debts are paid off. Thus, shareholder equity is equal to a company’s total assets minus its total liabilities.

Share Capital

- Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- A Statement Of Shareholder Equity can inform you if you should borrow more money to expand, whether you need to decrease costs, or whether you’ll profit from a sale.

- This document forms a core part of a company’s financial statements, alongside the balance sheet, income statement, and cash flow statement.

- Using the amounts from above, the ABC Corporation had free cash flow of $31,000 (which is the $126,000 of net cash provided from operating activities minus the capital expenditures of $95,000).

- There will be grand total figures at the top and bottom of the matrix for the total amount of beginning and ending shareholders’ equity.

- One common misconception about stockholders’ equity is that it reflects cash resources available to the company.

For mature companies consistently profitable, the retained earnings line item can contribute the highest percentage of shareholders’ equity. In these types of scenarios, the management team’s decision to add more to its cash reserves causes its cash balance to accumulate. The formula to calculate shareholders equity is equal to the difference between total assets and total liabilities. If shareholders’ equity is positive, that indicates the company has enough assets to cover its liabilities.

Which of these is most important for your financial advisor to have?

Enhanced reputation and improved customer and employee satisfaction from effective CSR and sustainability initiatives could increase the company’s value. This in turn can elevate stock prices, thereby resulting in an increasing shareholders’ equity. Hence, while there may be short term implications, the long-term positive outcomes are substantial. The retained earnings portion reflects the percentage of net earnings that were not paid to shareholders as dividends and should not be confused with cash or other liquid assets. Let’s assume that ABC Company has total assets of $2.6 million and total liabilities of $920,000.

Components of Stockholder’s Equity Statement

In this article, Innovature BPO will go over the components of the shareholders’ equity statement and provide an example. The total shareholders’ equity is calculated as the difference between the total assets a company has and the total liabilities or debt. While assets are the company’s resources and include everything from cash to physical items, liabilities are the debt it requires repaying. The liabilities count is normally built while the example statement of stockholders equity firms arrange funds to spend on assets.

For example, if a company has assets of $15,000 and liabilities of $10,000, its stockholders’ equity would be $5,000. Treasury Stock is the value of shares bought back/ repurchased by the company. This ending equity balance can then be cross-referenced with the ending equity on the balance sheet to make sure it is accurate. Moreover, if such initiatives do not yield anticipated financial returns, they could lead to a decline in total shareholders’ equity. Such a scenario may create tension with shareholders, particularly those that primarily focus on https://www.instagram.com/bookstime_inc financial returns.

Negative shareholder equity means that the company’s liabilities exceed its assets. If a company’s shareholder equity remains negative, it is considered to be balance sheet insolvency. Current assets include cash and anything that can be converted to cash within a year, such as accounts receivable and inventory. The shareholders equity ratio, or “equity ratio”, is a method to ensure the amount of leverage used to fund the operations of a company is reasonable.